Sanofi Acquires Blueprint in $9.1B Deal to Bolster Rare Immunological Disease Pipeline

Sanofi has announced a definitive agreement to acquire Blueprint Medicines, a U.S.-based biopharmaceutical company focused on systemic mastocytosis (SM) and KIT-driven diseases, in a deal valued at up to $9.5 billion. The transaction includes an upfront payment of $129.00 per share in cash, representing approximately $9.1 billion in equity value, and the issuance of one non-tradeable contingent value right (CVR) per share, entitling holders to up to $6 more based on development and regulatory milestones for BLU-808, Blueprint’s investigational wild-type KIT inhibitor.

Ayvakit boosts Sanofi’s leadership in systemic mastocytosis

Through this acquisition, Sanofi brings into its fold Ayvakit/Ayvakyt (avapritinib), the first and only approved treatment for both advanced and indolent systemic mastocytosis in the U.S. and EU. The oral precision therapy targets KIT and PDGFRA mutant kinases, which are key drivers of mast cell activation and proliferation in SM. Ayvakit generated $479 million in global net revenue in 2024 and $150 million in Q1 2025, achieving more than 60 percent growth over the same quarter the previous year. It is approved in 16 countries and marketed in China through a partnership with CStone Pharmaceuticals.

Pipeline expansion includes next-gen and early-stage KIT inhibitors

In addition to Ayvakit, the acquisition adds elenestinib, a next-generation KIT D816V inhibitor in Phase 2/3 development for indolent and smoldering SM, and BLU-808, an investigational oral wild-type KIT inhibitor with potential across a range of inflammatory diseases. Elenestinib is being evaluated in the ongoing HARBOR trial (NCT04910685), a randomised, double-blind, placebo-controlled study. Both programs build on Blueprint’s scientific leadership in mast cell biology and its efforts to target root causes of immune dysregulation.

Leadership statements emphasise alignment in rare and immunological disease strategy

Paul Hudson, CEO of Sanofi, commented:

“The proposed acquisition of Blueprint Medicines represents a strategic step forward in our rare and immunology portfolios. It enhances our pipeline and accelerates our transformation into the world’s leading immunology company. This acquisition is fully aligned with our strategic intent to strengthen our existing therapeutic areas, to bring relevant and differentiated medicines to patients and to secure attractive returns to our shareholders. It complements recent acquisitions of early-stage medicines that remain our main field of interest. Sanofi still retains a sizeable capacity for further acquisitions. We are excited to welcome Blueprint’s talented people and we look forward to chasing the miracles of science together. This makes sense for science, for both companies, for healthcare professionals, and – most of all – for patients.”

Kate Haviland, CEO of Blueprint Medicines, added:

“Since our founding, Blueprint Medicines has worked at the intersection of scientific innovation and operational excellence. I’m incredibly proud of the medical innovations our people have created and delivered to patients. We have translated our unique scientific understanding of mast cell biology into a portfolio of important therapies including Ayvakit – the first and only medicine approved to treat the root cause of systemic mastocytosis – and worked collaboratively with communities to improve standards of care and patient outcomes. With this agreement, we begin our next chapter with Sanofi, whose exceptional leadership in rare disease and immunology and proven ability to solve medical challenges at scale stand to accelerate our joint mission to bring life-changing medicines to many more patients around the world.”

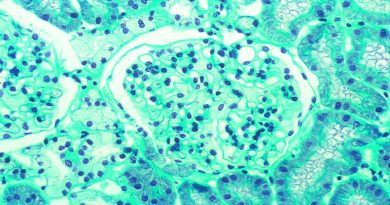

Systemic mastocytosis and unmet need in immunology

Mast cells, which play a central role in immune responses, release inflammatory mediators like histamine and proteases when activated. In systemic mastocytosis, mast cells accumulate in organs such as the bone marrow, skin, and gastrointestinal tract, leading to symptoms like anaphylaxis, bone disease, GI distress, and skin lesions. ISM accounts for the majority of SM cases and remains an area of high unmet need. Ayvakit is currently approved for both ISM and advanced SM subtypes, including aggressive SM, SM with an associated hematologic neoplasm, and mast cell leukemia.

Sanofi’s largest deal since Bioverativ underscores shift toward rare disease

Sanofi’s acquisition of Blueprint Medicines marks its most significant M&A move since the $11.8 billion purchase of hemophilia specialist Bioverativ in 2018. With this latest deal, Sanofi secures Blueprint’s rare immunological disease portfolio, led by Ayvakit, an oral treatment for systemic mastocytosis that posted $479 million in sales last year. Blueprint has projected peak sales potential for Ayvakit to reach $2 billion. The acquisition further underscores Sanofi’s strategic pivot toward rare and specialty diseases following a failed bid in 2022 to acquire Horizon Therapeutics, which was ultimately scooped up by Amgen in a $27.8 billion transaction.

Financial structure and timeline of the transaction

Under the terms of the merger agreement, Sanofi will launch a tender offer to acquire all outstanding Blueprint shares. The upfront offer represents a 27 percent premium over Blueprint’s May 30, 2025 closing share price and a 34 percent premium over the 30-day volume weighted average. Including the CVR payments, the deal reflects a 33 percent premium over the May 30 closing and a 40 percent premium over the 30-day VWAP. Sanofi plans to finance the transaction with a mix of cash on hand and new debt. The acquisition is not subject to financing conditions and is expected to close in the third quarter of 2025, pending regulatory approval and a majority tender of Blueprint shares.

Sanofi stated that the acquisition will not significantly affect its 2025 financial guidance, but is expected to be immediately accretive to gross margin and to boost operating income and EPS beginning in 2026.

Recommended Companies

More Headlines