Ironwood to Acquire VectivBio for $1B in Late-stage Digestive Therapy Deal

The $1 billion acquisition deal is set to advance Ironwood’s vision of becoming the leading gastrointestinal healthcare company.

Ironwood Pharmaceuticals, Inc., a company focused on gastrointestinal (GI) healthcare, and VectivBio Holding AG, a clinical-stage biopharmaceutical company specialising in transformative treatments for severe rare gastrointestinal conditions, have announced a definitive agreement for Ironwood to acquire VectivBio.

The acquisition will be an all-cash transaction at $17.00 per share, totaling approximately $1 billion, taking into account VectivBio’s cash and debt. The acquisition price represents an 80% premium compared to the average share price over the past 90 trading days. The transaction is subject to customary conditions, including the tender of over 80% of VectivBio’s shares and regulatory approvals. The acquisition is expected to be completed in the second half of 2023.

VectivBio, headquartered in Basel, Switzerland, is a clinical-stage biotechnology company focused on developing treatments for severe rare conditions, including Short Bowel Syndrome with Intestinal Failure (SBS-IF) and acute Graft versus Host Disease (aGvHD). SBS-IF is a debilitating condition that requires ongoing intravenous administration of fluids and nutrients, causing significant morbidity and mortality. aGvHD, on the other hand, is an immunologically mediated disease that affects individuals undergoing stem cell transplantation.

VectivBio’s lead investigational asset, is a next-generation GLP-2 analog

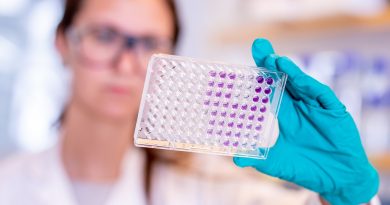

Apraglutide, VectivBio’s lead investigational new drug, is a next-generation long-acting synthetic GLP-2 analog currently in Phase 3 clinical trials. It is being developed for a range of rare gastrointestinal diseases where GLP-2 can play a central role in addressing disease pathophysiology, including short bowel syndrome with intestinal failure (SBS-IF) and Acute Graft-Versus-Host Disease (aGVHD).

Apraglutide has shown promising results and is being evaluated as a potential treatment for SBS-IF. Apraglutide’s unique convenience of weekly dosing, potency, and its clinical benefits for both SBS-IF stoma and colon-in-continuity patients make it a potential best-in-class therapy. If approved, Ironwood estimates that apraglutide has the potential to generate peak net sales of $1 billion.

By acquiring VectivBio and its innovative pipeline, Ironwood aims to strengthen its portfolio and advance the treatment of GI diseases. Ironwood, known for its successful GI commercial function and expertise in clinical development, regulatory pathways, and medical affairs, is well-positioned to maximize the potential value of apraglutide for patients, physicians, and shareholders. The acquisition aligns with Ironwood’s mission to reduce the burden of GI diseases and address unmet needs in the field.

Tom McCourt, Chief Executive Officer of Ironwood said:

“The acquisition of VectivBio, including its compelling asset, apraglutide, is an ideal strategic fit with Ironwood. With the success of our blockbuster product, LINZESS, we have built a strong GI commercial function, healthy cash flow generation, and meaningful EBITDA. We are confident that with our GI expertise, commercial capabilities, and robust balance sheet, we are well-positioned to continue developing apraglutide, with the goal of getting it into the hands of the patients who need it the most and potentially generate significant and sustainable value for shareholders.”

Luca Santarelli, M.D., Chief Executive Officer and founder of VectivBio stated:

“We are delighted to enter into this agreement with Ironwood to advance the development and commercialization of innovative therapies targeted at GI and rare diseases, which is the mission of VectivBio. Ironwood’s capabilities and established track record in GI make it the ideal company to bring apraglutide, if approved, to patients suffering from SBS-IF and other serious GI conditions. We believe this Transaction represents the best outcome for our patients and shareholders.”

The acquisition of VectivBio and the addition of apraglutide to its portfolio provide Ironwood with strategic and financial benefits. It strengthens Ironwood’s existing portfolio and pipeline, leverages its infrastructure and commercial capabilities, and supports long-term profitability and cash-flow generation. Ironwood anticipates the transaction to be accretive to earnings per share beginning in 2026.

The Transaction Agreement includes a tender offer to purchase all outstanding shares of VectivBio, subject to certain conditions. The transaction is expected to close in the second half of 2023. Ironwood plans to finance the acquisition using cash on hand and funds drawn through a revolving credit facility.

Ironwood has enlisted the services of financial advisors Citi, J.P. Morgan Securities, RBC Capital Markets, and Wells Fargo Securities, while VectivBio has engaged Centerview Partners and BofA Securities as financial advisors. Legal advice is being provided by Latham and Watkins, Advestra AG, Cooley (UK) LLP, and Homburger AG.

Additional details and updates regarding the acquisition will be provided by Ironwood upon the closing of the transaction.

Recommended Companies

More Headlines