Pfizer to Accelerate Cancer Breakthroughs with $43 Billion Seagen Acquisition

Pharma giant Pfizer and American biotech company Seagen officially announced on Monday that they have reached a conditional merger agreement under which Pfizer will acquire Seagen for approximately $43 billion in total enterprise value, or $229 per Seagen share in cash.

Seagen is a global biotechnology company that discovers, develops, and markets transformative cancer treatments. The deal has received unanimous approval from the boards of directors of both companies. The proposed deal strengthens Pfizer’s status as a leading pharma company developing therapeutics in Oncology. Pfizer’s oncology portfolio will be enhanced by Seagen’s medications, late-stage development program and groundbreaking expertise in antibody-drug conjugates (ADCs).

Dr. Albert Bourla, Pfizer Chairman and Chief Executive Officer stated:

“Pfizer is deploying its financial resources to advance the battle against cancer, a leading cause of death worldwide with a significant impact on public health.”

“Together, Pfizer and Seagen seek to accelerate the next generation of cancer breakthroughs and bring new solutions to patients by combining the power of Seagen’s antibody-drug conjugate (ADC) technology with the scale and strength of Pfizer’s capabilities and expertise. Oncology continues to be the largest growth driver in global medicine, and this acquisition will enhance Pfizer’s position in this important space and contribute meaningfully to the achievement of Pfizer’s near- and long-term financial goals.”

From its four in-line medicines, royalties, collaborations, and license agreements, Seagen anticipates making around $2.2 billion in revenue in 2023, which is roughly a 12% increase from the previous year. Pfizer thinks Seagen could contribute more than $10 billion in risk-adjusted revenues in 2030, with potential significant growth beyond 2030, when combining the anticipated strong growth trajectories for these drugs with candidates that could emerge from Seagen’s pipeline, subject to clinical trial and regulatory success.

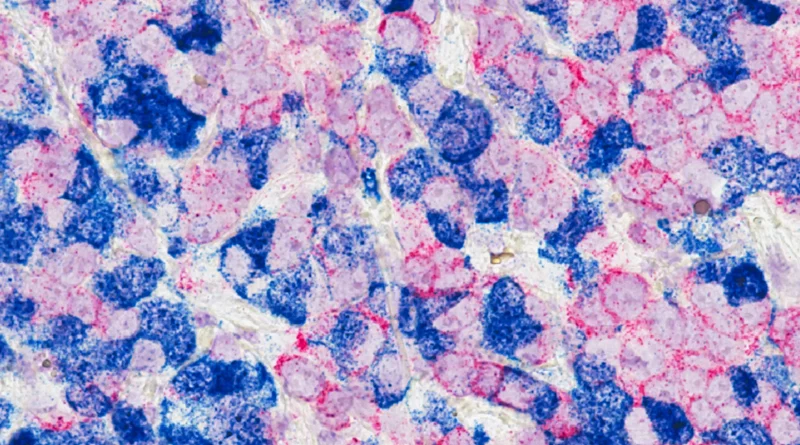

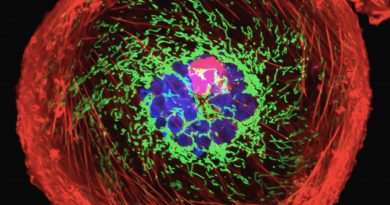

Pfizer to add groundbreaking antibody-drug conjugates (ADCs) to its portfolio

Four of the twelve Seagen-marketed ADCs have received FDA approval, making the biotech company a leader in ADC technology. ADCs are a revolutionary therapy that is proving to be an effective weapon against a wide variety of cancers with the advantage of preferentially killing cancer cells while reducing toxicities that are off-target. With ground-breaking and patented technology that is positioned for considerable growth in 2023 and beyond, Seagen has established a leadership position in ADC technologies since its establishment 25 years ago.

Four authorized drugs from Seagen’s portfolio treat solid tumors and hematologic malignancies and are first- or best-in-class in their respective indications, including three ADCs: ADCETRIS® (brentuximab vedotin), PADCEV® (enfortumab vedotin), and TIVDAK® (tisotumab vedotin). The business also manufactures TUKYSA® (tucatinib). With catalysts anticipated annually through 2027, clinical research programs for each of these medications are ongoing for possible additional tumor types or extended indications in earlier lines of therapy.

With a wide and deep pipeline that comprises eleven novel molecular entities, several of which have the potential to treat sizable patient populations and all of which have global commercial rights, Seagen is also well-positioned to increase the therapeutic approach’s effect.

Seagen’s ADC technology to benefit from Pfizer’s expertise in protein engineering and medicinal chemistry

The proposed acquisition is anticipated to enable combination potential for both the Seagen and Pfizer pipelines. It will also advance Seagen’s ADC technology by utilizing Pfizer’s expertise in protein engineering and medicinal chemistry to potentially unlock novel target combinations and next-generation biologics.

Moreover, Seagen is developing cutting-edge technologies that might result in many Investigational New Drug Applications (INDs), such as novel antibody platforms and next-generation linker/payload technologies for ADCs, which directly activate the immune system to kill tumors, such as bi-specific antibodies.

David Epstein, Seagen Chief Executive Officer commented:

“Pfizer shares our steadfast commitment to patients, and this combination is a testament to the passion, dedication and talent of the Seagen team to achieve our mission to discover, develop, and commercialize transformative cancer medicines that make a meaningful difference in people’s lives.”

“The proposed combination with Pfizer is the right next step for Seagen to further its strategy, and this compelling transaction will deliver significant and immediate value to our stockholders and provide new opportunities for our colleagues as part of a larger science-driven, patient-centric, global company.”

Pfizer to double its early-stage oncology clinical pipeline

Today, Pfizer Oncology has an industry-leading portfolio of 24 approved innovative cancer medicines that generated $12.1 billion in 2022 revenues, including the best-selling therapies for metastatic breast cancer and prostate cancer. Pfizer’s in-line portfolio is focused on four broad, key areas: breast cancer, genitourinary cancer, hematology and precision medicine, complemented by an extensive pipeline of 33 programs in clinical development. The proposed combination with Seagen would double Pfizer’s early-stage oncology clinical pipeline.

Chris Boshoff, Chief Development Officer Oncology and Rare Disease, Pfizer, said:

“Over the past decade we’ve taken bold new approaches to translating scientific research into effective medicines for people living with cancer, and we have pioneered several breakthroughs in breast cancer, genitourinary cancer, hematological malignancies and precision medicine.”

“The addition of Seagen’s world-leading ADC technology will position us at the forefront of innovative cancer care, and strongly complements our existing portfolio across both solid tumors and hematologic malignancies. We believe the combination of our teams, and respective areas of strength and global footprints will allow us to realize Seagen’s potential and advance even more potential breakthroughs to patients with cancer.”

Pfizer anticipates funding the acquisition in large part with $31 billion in new long-term debt and the remaining amount with a combination of short-term credit and available cash. In the third to fourth full year following the completion, it is anticipated that the transaction will be neutral to modestly accretive to adjusted diluted earnings per share (EPS). Pfizer anticipates saving close to $1 billion in costs in the third full year following the transaction’s conclusion.

Subject to satisfying the usual closing conditions, which include receiving the necessary governmental approvals and the approval of Seagen’s stockholders, the companies anticipate finalizing the transaction in late 2023 or early 2024.

For more information, please visit www.pfizer.com

Recommended Companies

More Headlines