Lilly to Expand Oncology Capabilities with POINT Biopharma Acquisition

Elly Lilly announced plans to acquire POINT Biopharma, with the strategic move set to boost Lilly’s oncology capabilities with next-generation radioligand therapies.

Leading pharmaceutical company Eli Lilly and Company has set its sights on a significant expansion in the field of oncology through the acquisition of POINT Biopharma Global, Inc. This acquisition agreement between Lilly and POINT, a radiopharmaceutical specialist with a promising portfolio of clinical and preclinical radioligand therapies designed for cancer treatment, will come at a cost of approximately $1.4 Billion.

Delivering radiation exclusively to cancer cells with next-gen radioligand therapy

Radioligand therapy is revolutionizing cancer treatment by enabling precise cancer cell targeting through the coupling of a radioisotope with a targeting molecule, delivering radiation exclusively to cancer cells while sparing healthy tissue from harm.

POINT’s foremost programs are advancing into late-phase development. PNT20021, a radioligand therapy directed at prostate-specific membrane antigen (PSMA), is in progress for patients with metastatic castration-resistant prostate cancer (mCRPC) following hormonal treatment resistance. Anticipated results from this study are slated for release in the fourth quarter of 2023. Meanwhile, PNT20031, a somatostatin receptor (SSTR) targeted radioligand therapy, is under development for the treatment of gastroenteropancreatic neuroendocrine tumors (GEP-NETs). Beyond its late-stage clinical pipeline, POINT is nurturing several early-stage clinical and preclinical programs. POINT’s extensive facilities, including a 180,000-square-foot radiopharmaceutical manufacturing campus in Indianapolis and a research and development center in Toronto, will complement its network of supply chain partners for sourcing radioisotopes and their precursors.

Jacob Van Naarden, President of Loxo@Lilly, the oncology unit of Eli Lilly and Company said:

“Over the past few years, we have seen how well-designed radiopharmaceuticals can demonstrate meaningful results for patients with cancer and rapidly integrate into standards of care, yet the field remains in the early days of the impact it may ultimately deliver. We are excited by the potential of this emerging modality and see the acquisition of POINT as the beginning of our investment in developing multiple meaningful radioligand medicines for hard-to-treat cancers, as we have done in small molecule and biologic oncology drug discovery and development. We look forward to welcoming POINT colleagues to Lilly and working together to build upon their achievements as we develop a pipeline of meaningful new radioligand treatments for patients.”

Joe McCann, Ph.D., CEO of POINT Biopharma added:

“The combination of POINT’s team, infrastructure and capabilities with Lilly’s global resources and experience could significantly accelerate the discovery, development and global access to radiopharmaceuticals. I look forward to a future where patients all over the world can benefit from the new cancer treatment options made possible by the joining of our two companies today.”

Lilly to Initiate $1.4 Billion Tender Offer for POINT Acquisition

To acquire POINT, Lilly will initiate a tender offer, offering $12.50 per share in cash (approximately $1.4 billion in total) payable upon closing. The transaction has received approval from the boards of directors of both companies.

The transaction is not contingent on financing and is expected to conclude by the end of 2023, subject to standard closing conditions, including the tender of a majority of POINT’s common stock and license transfer approval from the U.S. Nuclear Regulatory Commission. Following the successful tender offer, Lilly will proceed with a second-step merger to acquire any outstanding POINT shares, using the same consideration as the tender offer.

The purchase price at closing offers a premium of about 87% to POINT’s closing stock price on October 2, 2023, the day before the transaction announcement, and a 68% premium to the 30-day volume-weighted average price. POINT’s board of directors unanimously recommends that POINT’s stockholders participate in the tender offer.

The accounting treatment, whether as a business combination or asset acquisition under Generally Accepted Accounting Principles (GAAP), will be determined by Lilly upon closing. This transaction will subsequently be reflected in Lilly’s financial results and financial guidance.

Goldman Sachs & Co. LLC is serving as exclusive financial advisor and Kirkland & Ellis LLP as legal counsel for Lilly, while Centerview Partners LLC is POINT’s exclusive financial advisor and Skadden, Arps, Slate, Meagher & Flom LLP is the legal counsel for POINT.

Original Source: Eli Lilly and Company – Press Release

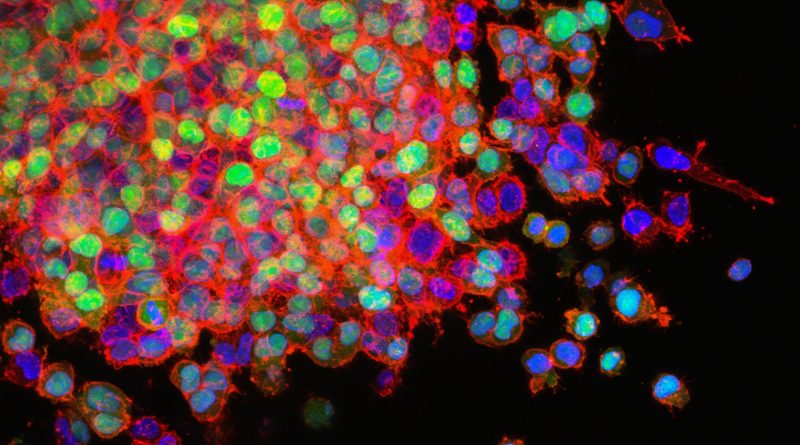

Top Image: Photo by National Cancer Institute on Unsplash, Lung Cancer

Recommended Companies

More Headlines